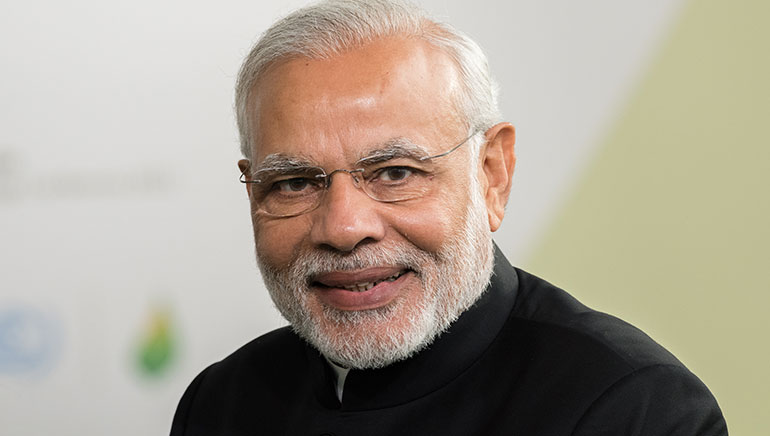

Narendra Modi can be banked upon one thing for sure – changing India for the better! He is one Indian leader who has been working to change things domestically and internationally for India without any fear. He has been consistently bold and revolutionary in cleansing and purifying the system. He has definitely taken some drastic measures trying to improve things; and without doubt, India needs these drastic steps to further improve its current political and economic scenario. The latest step of demonetisation was daring, which definitely shook things up, but all for a positive cause.

The night of November 8, 2016 is still fresh in most people’s memory, when Narendra Modi announced that all 500 and 1000 rupee notes would cease to be legal tender past midnight. Though most Indian political parties reacted that the manner of announcement without prior notice or planning was wrong, everyone agreed that the motive of demonetisation was right, and there was praise all along.

Mostly, people have saluted the PM for this historic move, which will surely make the future of India cleaner and more transparent. People understand that every change is difficult in the short run. They must also be confident that long-term gains are in the offing. Demonetization is always challenging in the short run, and can definitely turn advantageous in the medium and long run, if followed by the right policy measures.

As a matter of fact, demonetisation of Nov 8 was definitely inconvenient. The ensuing cash crunch was natural, as suddenly 86% of the currency in circulation ceased to be legal tender. However, it is important to understand demonetization better by analyzing its advantages and disadvantages.

Arun Jaitley, the Finance Minister of India has asserted that, “Demonetisation should be seen according to the effect on the economy. No doubt we will continue to be the fastest growing major economy. When you are in a cusp of history and you look at the long-term impact of these steps which are going to be taken, I think India is going to become a society in the long term with a certainly better GDP, cleaner ethics, a cleaner economy.”

DEMONETISATION AND INDIA

The current demonetisation move is a master stroke as simultaneously the following were targeted: a) Eliminating fake notes, b) Restricting generation of black money, c) Restricting terror funding and other subversive activities, d) Encouraging people to disclose all income and pay tax, e) Becoming more cashless and digitized, and f) Hitting the parallel economy.

Demonetisation is not new to India. It has been resorted to twice previously to combat tax evasion and the consequent black money – in 1946, which was before independence, and in 1978 by the Janata Party.

Irrespective of its impact, the current demonetisation is a golden opportunity to start afresh. The Indian economy has obtained a never-before chance to “restart”, where it can reset or control extensively elements of the economy such as liquidity, inflation, and even fiscal and external deficit. As the rate of outflow will definitely be lower than the rate of inflow, the deposits can be specifically utilized towards infrastructure, education, roads, defence, energy, health, housing and facilities for the underprivileged. It’s a great opportunity for various economic reforms.

Finally, demonetisation should not be construed as an end; it is a means to a greater end. Thus, it must be complemented by other policy measures to achieve its objectives.

CRITICISM OF DEMONETISATION

It must be accepted that it was definitely poorly planned and had a paralysing effect on economic activities in the short term. India is a cash-based economy where close to 83 percent of transactions materialise in the form of cash. As a result of demonetization, a cash deficit to the tune of Rs 8.5 trillion or 5.7 percent of the GDP is expected to materialise in the third quarter of FY17, which will reduce but continue into the fourth quarter of FY17.

Let’s look at some salient criticisms:

Wedding dampener: In India, cash is the only mode of payment for most petty products and services for marriages. However, social evils such as dowry and unnecessary expenses were hit.

Shrinkage of informal sector: The informal sector accounts for more than 40 percent of India’s GDP and provides employment to close to 80 percent of the labour force. Now, from the third quarter of FY17 to fourth quarter of FY19, the share of the informal economy in India could shrink from 40 percent to 20 percent, which would result in a short-term adverse effect as employment would reduce. However, it’s a great opportunity to set things right in the formal sector.

Rural woes: People in villages and semi-urban areas were the worst hit as they are almost entirely dependent on cash. However, it is a great opportunity to penetrate into these areas and teach the people the goodness of digitization, the organized sector and the banking system. Overall, the rural population has taken well the idea of India as a future digital economy.

Low economic growth: This is one of the biggest threats. Former Prime Minister Manmohan Singh, also an economist, has already suggested contraction in GDP by 2 percent. The Reserve Bank of India in its policy statement has also cut down growth forecast to 7.1 percent from 7.6 percent earlier for the current fiscal year.

Increase in unemployment: According to CPM’s Sitaram Yechury, since 8 November, four lakh jobs have vanished, and more will follow in construction and allied sectors, jewellery, textiles, leather and real estate.

Cost of printing new currency: This is an additional cost to the exchequer and entirely unnecessary. However, it should motivate India to go digital.

SHORT- AND MEDIUM-TERM BENEFITS

Every criticism of demonetisation is valid; however, it’s not devoid of positives. Demonetisation was a calculated move though the timing may not have been perfect. About five months back, the Income Declaration Scheme for all citizens was launched. Before that, Jan Dhan Yojana had already been implemented. Other policy measures to complement demonetisation include Revised Double Taxation Avoidance Agreement (DTAA) with Mauritius and Cyprus, The Benami Transactions (Prohibition) Amendment Act, 2016, and Pradhan Mantri Garib Kalyan Yojana (PMGKY), 2016.

Let’s consider some short- and medium-term benefits:

Counterfeit and unaccounted notes: Deep-rooted fake notes and unaccounted cash of the past many decades were tracked. Either they came back into the system, or became detritus. However, banks struggling because of NPA (non-performing assets or bad loans) have money to lend for agriculture, infrastructure, and social sector, as also for trade and industry.

Black money: 40 years had passed since the last demonetization, and a large amount of black money had been generated. Black money can’t be wiped out totally from the economy; however, gradual and slow processes will never be able to hit the black money generation in a way this latest demonetization move did. Further, the psychological strike on black money has deeply demotivated the generators and hoarders of black money.

Boost in deposit base as well as financial savings: The total deposits in banks after demonetisation crossed Rs 12.44 lakh crore on December 10, 2016 according to data released by Reserve Bank of India. This has helped people switch from holding unproductive physical assets to financial assets.

Reduction in lending rates and improved monetary transactions: With the rise in deposit base with the banks through CASA (current accounts, savings accounts), the blended cost of funds has come down, and so has the cost of borrowing. Consequently, several banks have lowered the interest rates.

Marginal Cost of Funds-based Lending Rate: MCLR has reduced the lending rates and will boost the economic activity in the medium-term.

Strong bonds: Higher bank deposit base would lead to higher SLR (statutory liquidity ratio) demand. Anticipation of monetary easing will further support bonds.

Real estate: Prices are down and would become more realistic in the future.

Terrorism: An important source of funding of terrorists is black money and counterfeit money. Demonetisation and slow release of new notes also helped in this cause, as no cash was available for funding terrorist activities.

Gambling and Money laundering: Will be discouraged as they thrive on cash.

Discouraged drug peddling: Demonetisation made it hard for drug peddlers to demand and supply products.

Increased Tax Collection: As per Data from the Urban Development Ministry for November 2016 showed an increase of 268% in tax collection by 47 local bodies, as compared with November 2015. Also, till December 19 2017, direct tax mop-up rose 14.4%, indirect tax grew 26.2%, central excise was up 43.3%.

Others: Black money is also used to inflate prices of major assets such as real estate properties and gold. This will take a back seat for some time.

LONG-TERM BENEFITS

Long-term benefits are undeniable. Meaningful changes are already visible in terms of higher digitisation, greater tax compliance and lower realty prices.

Actually, demonetisation has provided the government and the Reserve Bank of India an iron ladder which, if utilized properly, may take the Indian economy higher than just being the world’s fastest growing economy. It’s time to become the most robust, most digitized and the most advanced economy in the world.

Banking liquidity: Increased considerably, now the money can be largely supplied back into the system through ATMs in a calculated and controlled way. The total liquidity in the economy can be controlled.

Banking the unbanked population: Banking habits of the entire population will improve. Opening bank accounts has almost become mandatory for every citizen. Those who can’t open bank accounts on their own, are being provided these by the government as Jan Dhan accounts.

Disclosures and income tax paid: Of course, not all black money returned due to monetisation. However, whatever was disclosed and income tax paid on that, was a positive. This should help cushion the government’s FY17 fiscal deficit target.

Formalisation Effect: Going digital would greatly enhance Indian economy’s chance to transform into an organized economy. This is likely to enhance the government’s ability to tax commercial transactions resulting in a structural improvement in tax to GDP ratio in the economy.

Improved international image: India’s position on transparency and corruption at the global stage will improve adding to its investor appeal.

New income tax payers: The number of new income tax payers as well as the magnitude of reported and taxable income will rise.

Financial inclusion: The new notes with higher security features will make the economy more transparent. Digital transactions will rise dramatically. India has the potential for digital financial inclusion.

DIGITIZATION DRIVE

One of the biggest advantages of demonetisation is India’s expedited movement towards digitization. After the successful drive of Aadhaar Card, maximum digitization is possible. Besides banks, online wallet companies including Paytm, MobiKwik and FreeCharge will support.

Positives of digitization: a) Log of every purchase, b) Increased tax revenue, c) No deposits or withdrawal of currency, d) Money will be constantly in circulation or in the bank, e) Chance to lower taxes, f) Billing would increase, g) Cost of printing currency would reduce, h) Bribes will reduce, i) Tax avoidance will decrease, j) Misuse of laws would reduce, k) Social evils would reduce, and l) Day-to-day life would become easier.

Caution in digitization: To increase trust and reduce frauds in digital payments, cybersecurity systems must be strengthened considerably. Inter-operability of the payments system must be ensured and the newly created Unified Payment Interface (UPI) system must be popularized. However, cash is not bad. Public policy must balance both cash and digital payments. Transition to digitalisation must be gradual, inclusive and not controlled, and digitally deprived must be supported.

SUGGESTIONS AND RECOMMENDATIONS

If India focuses on the right policies and measures, it will improve the economic condition at an unprecedented scale. The potential benefit to India and to the world is incalculable. India needs to seize opportunities by making smart investments in the right things boldly.

The following must be done immediately: fast, demand-driven remonetisation, a push to digital payments using incentives, bringing land and real estate (the long-suspected, main parking slot for black money) under the goods and services tax (GST) net, lowering tax rates and stamp duties, and improving the tax system.

In addition, the RBI should guarantee the public the amount of currency that the latter wants. The early elimination of withdrawal limits will build confidence; there should be no penalties on cash withdrawals. Tax reforms must be implemented and tax administration must be improved. For inclusive growth, the poor must be distributed subsidies through the Jan Dhan Aadhar Mobile mode (JAM).

Through other measures, people must be prevented from parking their savings in physical assets such as gold and real estate. The government must keep a tight leash on the corruption front. Low bank penetration in the rural areas and low financial literacy must be improved. Government must immediately generate a lot of employment opportunities by lending massively to the infrastructure sector.

India’s cash-to-GDP ratio is as high as 12%, roughly three times of even developing countries like Brazil and South Africa, as cash accounts for 98% transaction volumes and 68% of value. This needs to be reduced. There must be bold cut in tax rates.

CONCLUSION

Though India’s economic growth is likely to dip to 6.5 per cent this fiscal, it must rebound to 6.75-7.5 per cent in the next financial year, a number that largely agrees with IMF forecast of 6.6 percent. According to Chief Economic Advisor, Arvind Subramanian, “Even under this forecast, India would remain the fastest growing major economy in the world.”

Further, as per Economic Survey 2007, “Over the medium run, the implementation of GST, follow-up to demonetisation, and enacting other structural reforms should take the economy towards its potential real GDP growth of 8 per cent to 10 per cent.”

Significant financial data has been collected through the demonetisation drive. Similar to the population census data – where over a period of time relevant calculations are made, and appropriate policy measures or decisions are taken – this financial data would go a long way in improving financial conditions in the economy, making financial reforms and taking action against errant depositors.

And then, of course, as Mahatma Gandhi said, “A right cause never fails”.

DOMESTIC SUPPORT

Kailash Satyarthi (Nobel laureate): “It will check human trafficking and child slavery in the country.”

Adi Godrej (Chairman of Godrej Group): “Demonetisation is a good move for long term growth.”

Pankaj Jain (Group CEO, Logix Group): “Recent demonetization would not only bring more transparency and enhanced financial discipline in Indian economy but would also open the doors for a host of opportunities to new-age start-ups and entrepreneurs.”

INTERNATIONAL SUPPORT

World Bank President, Jim Yong Kim said, “I am a big fan of Modi!”

Washington Post: “… initiative is ambitious and … a crackdown against black money.”

The Independent: “Modi does a Lee Kuan Yew to stamp out corruption in India.”

Bill Gates: “It will help India move from shadow to a more transparent economy.”