The US and India aim to enhance information sharing on opioids like fentanyl to address its misuse in the US. Kristie Canegallo, acting deputy secretary at the US Department of Homeland Security, discussed this during the Senior Officials’ Homeland Security Dialogue in New Delhi. The dialogue is part of the 2010 India-US counter-terrorism initiative.

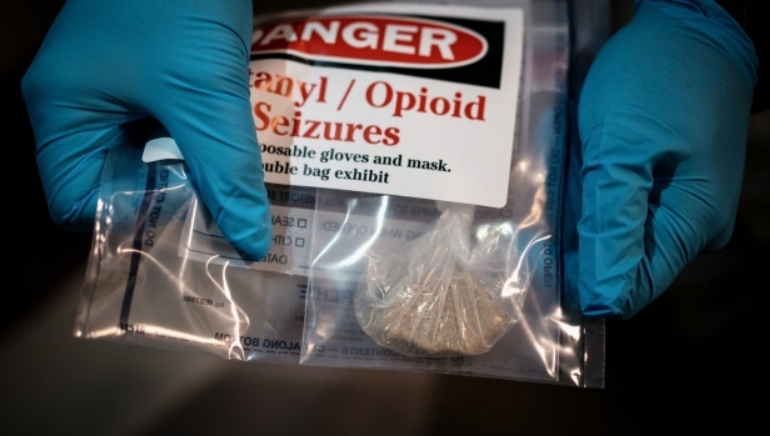

Canegallo emphasised augmenting information sharing, especially regarding fentanyl, amid existing counter-narcotics efforts. Synthetic opioids, mainly fentanyl, caused about

two-thirds of the 2021 drug overdose deaths in the US.

India legally produces and exports opioids, including fentanyl, to the US. While Mexico and China are primary sources, India’s role in trafficking such drugs has drawn the attention of the US Drug Enforcement Agency.

The disruption of precursor chemical fluxes was also discussed. In January, the US and China launched a joint anti-narcotics effort against fentanyl production and trade.

Addressing terrorism, discussions included the threat of radicalised individuals from ongoing conflicts and organised terror groups. Canagello highlighted the evolving threat landscape, acknowledging the increased risk of lone-wolf attacks on the US. Overall, the dialogue underscores bilateral efforts to tackle drug trafficking and terrorism, recognising the evolving nature of these challenges.