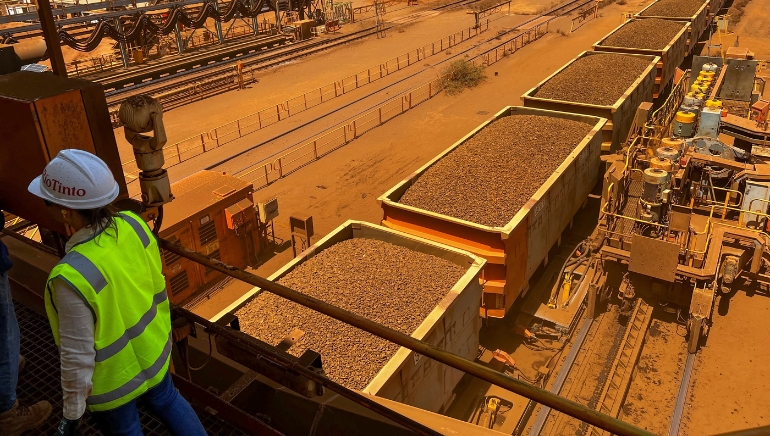

Australia is solidifying its place as a top destination for mining listings, with the Australian Securities Exchange (ASX) expected to see an increase in secondary listings this year. Mine developers are drawn to Australia because of its large pension riches, stable rules, and protection from US trade disputes, according to industry sources.

The ASX is increasing its market share in metals and mining, competing with Toronto and London as the industry strives for $100 billion in annual expansion to attain net-zero ambitions by 2050. While overall ASX listings have decreased, mining continues to grow.

Last year’s successful listing of Canadian copper miner Capstone sparked new interest, providing an exit for private equity and granting Australian investors access to a major copper mine. Sherif Andrawes of BDO highlighted growing interest from Canadian-listed corporations, describing the ASX as a healthier choice for exploration companies.

A big draw is Australia’s pension wealth, which is the world’s fourth largest, with assets worth A$4.1 trillion ($2.58 trillion). Local pension funds invest approximately 23% of their assets in domestic stocks, which is significantly more than Canada and the United Kingdom.