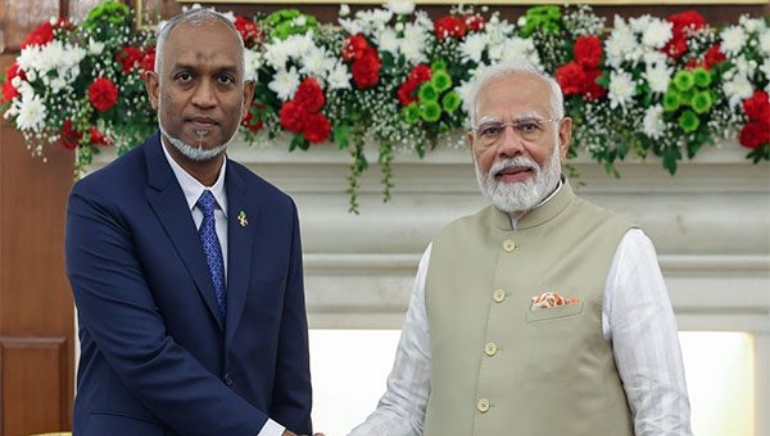

On October 7, Prime Minister Narendra Modi emphasised the importance of the Maldives in India’s ‘Neighbourhood First’ policy at a meeting with Maldivian President Mohamed Muizzu in New Delhi. Modi emphasised India’s consistent support, citing previous help provided to the Maldives during emergencies, such as vital commodities, drinking water during natural catastrophes, and COVID-19 vaccines.

Modi emphasised that development cooperation remains critical to India-Maldives relations. He announced a $100 million rollover by the State Bank of India for the Maldivian Treasury, as well as a $400 million and ₹3,000 crore currency swap agreement. “We have committed to comprehensive support for Maldives’ infrastructure development,” he said.

To strengthen economic connections, Modi cited the completion of over 700 social housing units built with Indian assistance and declared plans to pursue a free trade agreement. He also stated that India and the Maldives would soon join via the Unified Payments Interface (UPI), following the successful launch of RuPay cards in the Maldives.

The leaders also discussed security cooperation, with Modi highlighting the continuing work on the Ekatha Harbour project and India’s commitment to strengthening the Maldivian National Defence Forces. He reaffirmed India and the Maldives’ commitment to working together for regional peace and prosperity.