Serving Indian micro SMEs is very hard, as they are very budget conscious, yet they require highly specialized solutions that are not cost effective for the service providers. In fact, the main reason why most banks & fintech are unable to break even servicing this sector is because they are too expensive to market to, train & retain. One unique financial services provider that shows a lot of success servicing the micro-SME space is Indipaisa, an Indian Fintech that offers customized digital end to end banking solutions to the under-serviced & under-banked Indian micro-SME vertical. Indipaisa is already live & operational in Delhi/NCR, Uttar Pradesh, Maharashtra & Karnataka & now plans to further expand into Pan India states by next year. Indipaisa takes great pride in making of “Digital India”.

PRIOR TO LAUNCH, EXTENSIVE RESEARCH WAS CONDUCTED

Indipaisa team performed 30,000+ question surveys before releasing its services & spoke to hundreds of small & micro-SME owners to learn about their biggest pain points in managing finances.

UNDERSERVICED BY BANKS

Traditional banks give loans to big corporates more readily than MSMEs because the former usually offer more collateral assets. In fact, MSMEs also require easy loans & financing facilities to pick up new ventures. Therefore, Indipaisa is committed to helping small businesses acquire suitable loan facility packages & ensuring that they are compliant with government tax systems & avoid penalties with a seamless digital experience.

LEVERAGING ARTIFICIAL INTELLIGENCE (AI) & ML TECHNOLOGY

Indipaisa uses an AI & ML powered lending platform that makes finding the most suitable loan facility faster for companies. The team behind Indipaisa represents a combination of more than 200 years of experience in various sectors in fintech, digital banking, IT security & compliance.

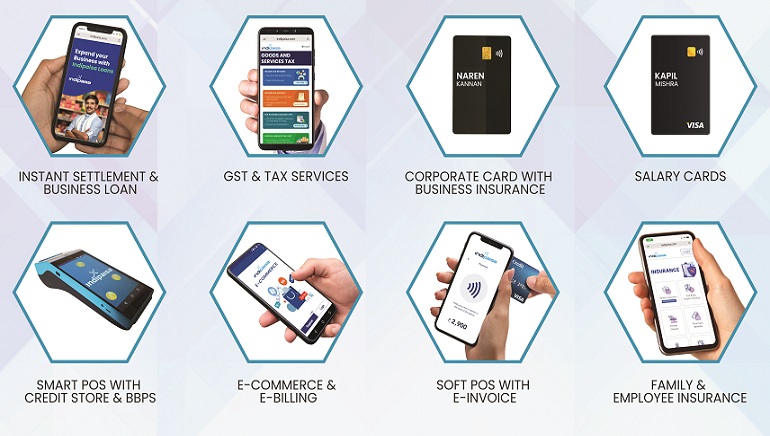

Indipaisa empowers small businesses with its financing tools like the all-in-one smart POS, E-commerce, Payroll, insurance, lending& tax filing which are key to MSME. Indipaisa solutions are built keeping the needs of local businesses in mind. Instant and working capital payout solutions to MSME save time, money, and effort resulting in higher profits over time.

The technology stack of Indipaisa takes care of every type of transaction for micro, small, and medium-sized businesses. For example, if merchants want to sell offline, they can use Smart POS devices or the Just-tap platform and benefit from store credit. Additionally, it uses AI to predict the cashflows, thus giving it a tremendous competitive advantage to tap into the highly fragmented Indian micro-lending market estimated to exceed $380bn; while delivering growth and profitability at low NPL ratios.

A LONG LIST OF TRUSTED PARTNERS

Last year, it partnered with the local payments bank, technology partners, insurance & loan providers & introduced various digital banking financial services & products that targeted local SME operators to deploy a FinTech platform for Indian MSME businesses. It is also a part of the Indian Government and RBI’s digitized payments drive.