India will join the US-led Indo-Pacific Economic Forum (IPEF) launched by President Joe Biden next week in Tokyo. The mega ‘economic arrangement’ is established in an effort to counter China’s rising economic clout.

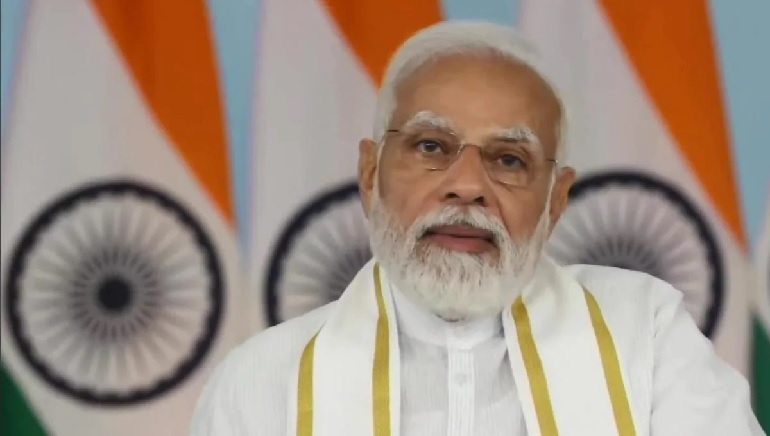

According to a top-level source, Biden will extend an invitation to Prime Minister Narendra Modi to join the IPEF in their meeting in Tokyo for Quad Summit. However, a source said India was initially reluctant to join the IPEF and was keen to have a bilateral trade pact with the US and plurilateral agreement under the Quad that included the US, India, Australia and Japan.

The IPEF will also have South Korea, Japan, Australia, New Zealand, Malaysia, Indonesia, Singapore, Vietnam, Thailand and the Philippines as members and more will be added later.

During Nirmala Sitharaman’s visit to the US last month, India and the US reached an understanding that although the IPEF will demand “high standards” by way of establishing and maintaining trade facilitation, supply-chain resilience and the infrastructure will nevertheless be a “strategic move” to target China.

Nevertheless, sources said New Delhi believes that even though IPEF is not a free trade agreement, it will help India deal with the China threat, as Beijing attempts to dominate all supply-chain linkages in Asia under the Regional Comprehensive Economic Partnership (RCEP), which was ratified on the 1 January 2022.