Visualization of a factory can never be complete without sweaty faces, grease-stained uniforms, metal clanking, groaning and creaking of machines and all the loading and unloading activity. In order to improve industrial output and steady economic progress, the United Arab Emirates (UAE) is seeking to change conventional ideas about manufacturing processes by using emerging technologies.

As part of the recently announced Fourth Industrial Revolution (4IR), the minister headed by H.E. Sultan Al Jaber aims to deploy innovative ideas and new technologies to expand manufacturing practices, adding greater economic value. In transforming the country’s manufacturing sector, Dubai will play a crucial role as the epicentre of all disrupting technologies in the MENA region.

The 4IR is a key pillar of the UAE’s Operation 300Bn whose goal is to increase the manufacturing sector’s contribution to the national GDP to Dh.25 billion in the next 10 years by enhancing industrial productivity by 30 per cent. Lauding the initiative taken by his counterpart, the UAE Minister of Economy, Abdulla bin Touq Al Marri, points out that the country is spawning an era of innovative ideas that impel a knowledge-based economy through future legislation.

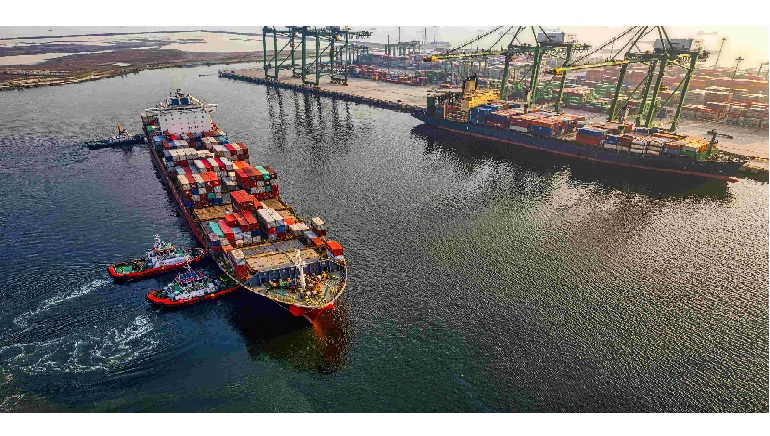

In order to address modern-day challenges, modern approaches are needed, says H.E. Minister of Industry and Advanced Technology of the UAE Sultan Al Jaber, who says that in order to recover from pandemic-like situations, industrial capacity must be strengthened, supply chains strengthened, and risks reduced. Al Jaber suggests a simple solution: harnessing new technologies and improving cross-border cooperation.