More than half a million people of Indian origin live in Singapore. However, this is not the only reason that India and Singapore have come closer than together on multiple levels and spheres.

India and Singapore relations go a long way and have widened and deepened consistently with time. When Singapore obtained its independence in 1965, China-backed communist threats loomed large, while Malaysian and Indonesian domination was also expected. Singapore found a close strategic relationship with India significant for its regional security, which also served as a counterbalance to Chinese influence in international politics. The fact that India had already fought a war against the Chinese in 1962 helped both sides to shake hands enthusiastically. In turn, Singapore has proved to be an important strategic trading post for India giving it trade access to the Far East.

There was a time when India and Singapore held rival positions on the Vietnam War and the Cold War, as they belonged to two different camps on international foreign policy. Singapore chose to ally with North Atlantic Treaty Organization (NATO), while India being a founding member of the Non- Aligned Movement (NAM), not only supported Vietnam’s independence from France, but also opposed American involvement in the Vietnam War. It also supported unification of Vietnam, and during the Vietnam War, supported the North without militarily opposing the South.

However, India and Singapore grew their relationship strategically and judiciously in the 1990s, when Singapore responded favourably to India’s “Look East” Policy with a long-term vision of expanding its economic, cultural and strategic ties in Southeast Asia to strengthen its standing as a regional power.

India’s Look East policy of 1992, when it embarked upon the path of economic liberalization and export promotion, was immediately responded to by Singapore with a parallel “Look West” Policy. In addition, Singapore has always extended a hand of political support towards India in multiple ways, including getting India into ASEAN as a dialogue partner, getting it the membership of the ASEAN Regional Forum (ARF), and also in initiating ASEAN-India Summit meetings. Then, Singapore (and also Japan) also supported India’s entry in the East Asia Summit (EAS). This fact becomes more significant in the light that India got an entry even when China and Malaysia opposed it. Singapore’s continued efforts also resulted in India’s first-ever Free Trade Agreement (FTA) with any ASEAN country. As a result, India could initiate a politico- strategic relationship with Singapore at two levels simultaneously: bilateral and ASEAN-centric.

ASEAN is composed of 10 countries: Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, Myanmar, Cambodia, Brunei and Laos. The ASEAN countries account for 9.5 percent of India’s total commodity exports, and within ASEAN, Singapore alone absorbs 4.5 percent of India’s exports. From India’s perspectives, Singapore is India’s 10th largest source of imports. At present, it accounts for 3.27 percent of India’s total commodity imports.

Opening New Avenues

Navies of both countries started conducting joint naval exercises and training in 1993, by the names SIMBEX and MILAN near Andaman and Nicobar Islands, and gradually expanded their cooperation in fighting terrorism. SIMBEX is an annual naval combat exercise, and several warships from India and Singapore take regular and active part in this interoperable combat exercise.

As the relationship matured, India and Singapore signed a Defence Cooperation Agreement in 2003, on expanding military cooperation, conducting joint military training, developing military technology and achieving maritime security. As decided under the Agreement, Singapore army and air force may conduct training on Indian soil.

In 2016, India and Singapore signed another agreement for creating a strategic relationship across the board, which includes defence and military, security and intelligence cooperation, political exchanges, enhancing trade and investment, improving financial linkages, improving air connectivity and cooperation in multilateral forums.

A year later in 2017, both signed a Naval Cooperation Agreement for boosting maritime security, joint exercises and mutual logistics support. This Agreement also allows ships of either navy to refuel, restock and rearm at each other’s military bases. The camaraderie between India and Singapore may be judged by the statement of Singapore’s Defence Minister Dr. Ng Eng Hen, who stated after signing the agreement that, “not only would we be more comfortable, we would encourage the Indian Navy to visit Changi Naval base more often”. In addition, the Republic of Singapore Air Force (RSAF) and the Indian Air Force (IAF) regularly conduct joint military training exercises.

Military cooperation of several decades has now transformed into resolving common security challenges for both countries, such as terrorism, maritime piracy, safety of Sea Lanes of Communications (SLoCs), etc. Set up in 2006, they conduct high-level discussions on defence and security through India-Singapore Defence Policy Dialogue. In addition, they cooperate with each other in their fight against terrorism through a Mutual Legal Assistance Treaty in criminal matters.

Evolving a Meaningful Relationship

India and Singapore established diplomatic relations fifteen days after Singapore’s independence in 1965. They kept their relationship alive, and grew it consistently as top leaders from both countries took active interest and action. In the next six years, the erstwhile Prime Minister of Singapore Lee Kuan Yew visited India three times, in 1966, in 1970 and in 1971. In between, the former Indian Prime Minister Indira Gandhi and Deputy Prime Minister Morarji Desai also visited Singapore in 1968. As a sign of close positive relationship, Singapore supported India for a permanent seat at the United Nations Security Council, in cultivating a greater role and influence in the Association of Southeast Asian Nations (ASEAN), in India’s war against Pakistan in 1965, and in the Kashmir conflict.

As the military cooperation enhanced from both sides in the 1990s and 2000s, in the last two decades, both have created economic, political and cultural hubs for each other within their countries. Over time, Singapore has emerged as a strategic partner for India in the Southeast Asia.

In the words of the then Indian Defence Minister, Pranab Mukherjee, in 2006, “Singapore has become the hub of India’s political, economic and security strategy in the whole of East Asia.”

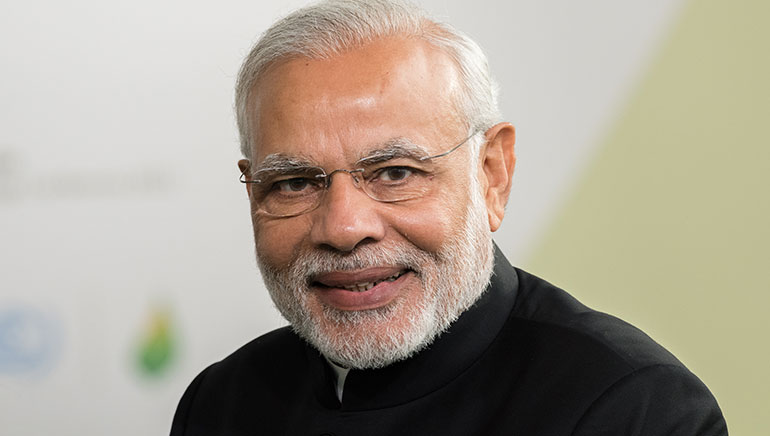

As Singapore completed 50 years of India–Singapore bilateral relations in 2015, Prime Minister Narendra Modi visited Singapore. The Father of Singapore, Lee Kuan Yew, also breathed his last in 2015 and India declared national mourning in his memory.

Great Source of Investment

Singapore is a significant economic partner of India, as after Mauritius, it is the second-largest source of foreign direct investment into India as of 2017–18, and is the largest among the ASEAN member nations.

In 2005, India and Singapore signed the Comprehensive Economic Cooperation Agreement (CECA) as they decided to take their strategic partnership to the next level, and garnering support from the Federation of Indian Chambers of Commerce and Industry (FICCI), the Confederation of Indian Industry (CII) and the Singapore Business Federation to promote trade, economic development and partnerships, it organized the India-Singapore Parliamentary Forum and the Singapore-India Partnership Foundation. Singapore is the first country with which India signed such an agreement.

CECA came into force after much deliberations from both countries, as first the former Indian Prime Minister, Atal Bihari Vajpayee, visited Singapore in 2002, and then during his visit the India–Singapore Joint Study Group was set up, which recommended for the Agreement. Then, for two years, 13 rounds of negotiations took place, and modalities and formalities of the Agreement were discussed and decided. The first review of CECA was done in 2007.

CECA has brought major transformations and excellent results, as it has completely removed tariff barriers, double taxation, duplicate processes & regulations, and has also offered unhindered access and collaboration between the financial institutions of Singapore and India. CECA has also facilitated alliances in Singapore. In 2018, this figure has gone up by 14 per cent compared to that of 2017.

Buoyed by the success of agreements and policies under CECA, Narendra Modi visited Singapore in June 2018 for the second review of the India- Singapore Comprehensive Economic Cooperation Agreement with the Singapore Prime Minister Lee Hsien Loong. The third review has come quite close to the heels of the second review, as in September 2018, India and Singapore formally launched the third review of CECA focusing on trade facilitation, e-commerce and customs. As explained by Mr Iswaran, the third review became important after just four months of the second review because, “CECA has opened up market access for Singapore companies in a variety of sectors including finance, organic chemicals, plastics, as well as electrical machinery and equipment. Our companies also benefit from CECA’s investment protection and dispute resolution provisions, and to Mauritius. They also have mutually improved market access for each other, and have implemented fair and impartial domestic regulations. They promote and protect bilateral trade, and both have unrestricted access to their banks in each other’s country. Temasek Holdings and the Government of Singapore Investment Cooperation (GIC) also have special enhanced investment limits on financial services such as between the stock exchanges of the two countries.

Temasek Holdings is the sovereign wealth fund of Singapore government, and its India portfolio stands at around USD 10 billion. It plans to increase its portfolio further in India, with its India investments in the first three months of 2018 being around USD 1.5 billion. Other components of India– Singapore CECA include economic cooperation in areas like education, science, technology, air services and intellectual property, and relaxed visa regimes for Indian professionals in several areas such as information technology, medicine, engineering, financial, and advertising professionals. The second review of India– Singapore CECA was done by the Singapore Prime Minister Lee Hsien Loong and India Prime Minister Narendra Modi, and through the review the provisions of the agreement were enhanced by means of greater trade facilitation, that is both Singapore and Indian businesses were allowed increased access to each other’s markets.

Tariff concessions were also expanded under the review, for 30 additional products and rules of origin were improved to provide more flexibility for Singapore exports into India to qualify for preferential tariffs under the agreement. S Iswaran was Singapore’s Minister- in-charge of Trade Relations at that time, and he noted, “The upgraded agreement will enable more Singapore companies to qualify for lower tariffs. This improves local exporters’ access to the Indian market. I encourage our companies to make full use of the upgraded agreement and explore more opportunities for collaboration in India.”

In 2017, the total bilateral trade between Singapore and India had and partnerships related to education, science & technology, intellectual property, aviation and relaxed visa regulations for Indian professionals in information technology, medicine, engineering and financial fields to emigrate and work in Singapore.

Under the same agreement, Singapore has invested in projects to upgrade India’s ports, airports and developing information technology parks and a Special Economic Zone (SEZ). With the enhancement of bilateral relations, Indian tourists entering Singapore broke their previous record, as in 2017, 1.27 million travelers went to Singapore. This also made India the third- highest contributor of visitor arrivals can do business in India with greater confidence.” Further, the fact that India’s economy not only continuously expanded at the fastest pace in nine quarters, but domestic consumption and manufacturing also grew strongly has given confidence to businesses on both sides.

India–Singapore CECA benefits both countries in the following ways: there are Mutual Recognition Agreements (MRAs) which help in eliminating duplicate testing and certification of products, then a Joint Council oversees the MRAs. They have a Double Taxation Avoidance Agreement that offers zero capital gains tax for Singaporean companies similar to concessions given by India reached a figure of S$25.2 billion, as India had emerged as Singapore’s largest trading partner in South Asia, while Singapore became India’s second-largest trading partner within ASEAN. Foreign Direct Investment from India to Singapore increased by S$19.3 billion and the Direct Investment Abroad from Singapore to India increased by S$35.6 billion in 2017 from 2005 when the CECA was first signed.

Top imports from India in 2017 include petroleum oils as well as jewellery and precious metals. Top exports to India in 2017 include machineries, petroleum oils, styrene and gold.

Positive Outlook

The warmth in strategic relationship of India and Singapore has grown because of the direct involvement of top leadership from both sides. Prime Minister Narendra Modi feels that, “The future is a world of unlimited opportunities and the two lions (India and Singapore) shall step into it together. The defence relations between the two countries are among the strongest and the two sides are building a ‘partnership of our age.’ When India opened up to the world and turned to the East, Singapore became a partner and a bridge between India and ASEAN. Political relations between India and Singapore are among the warmest and closest. There are no contests or claims, or doubts.”

He further shared, “It is a natural partnership from a shared vision. Our defence relations are among the strongest, for both. My Armed Forces speak with great respect and admiration for Singapore’s Armed Forces. India’s longest continuous naval exercise is with Singapore. It is a partnership at the front-line of India’s global engagement. Singapore is both a leading investment source and destination for India. Singapore was the first country with which we signed a Comprehensive Economic Cooperation Agreement. On the foundations of an extraordinary heritage, the wealth of our human links and the strength of our shared values, India and Singapore are building a partnership of our age. It is a relationship that truly meets the test of strategic partnership.”

With growing engagement, Singapore has started being a key partner in India’s development priorities, such as smart cities, urban solutions, financial sector, skills development, ports, logistics, aviation and industrial parks. India and Singapore have been contributing to each other’s prosperity, and building new partnerships with the passage of time, they have been together building a digital world, using each others’ initiatives for innovations and enterprises.

India and Singapore have several common chords connecting their hearts, and cultural & entrepreneurial arms. Together they have been working to create and enhance the power of mobile and digital technology, with the target of bettering governance and making inclusion possible.

Singapore is small in size, but with global dreams it has proved that nations’ greatness and achievements are not dependent on geographical size. It has not just positively used the strength of its multi-cultural society, but has actually celebrated its diversity, creating a unique Singaporean identity.

Ancient & Modern Connections

India and Singapore could quickly create highly mutually beneficial relationship because of their centuries-old historical and cultural connect which is deep-rooted. India’s centuries-old trade with the South East Asia was possible as trade routes passed through Singapore. Both countries had powerful commercial, cultural and people-to-people links.

Actually, India and Singapore have been connected for trade since the Chola regime in Ancient India. In the modern India, British governing from Calcutta established a trading station in Singapore on the route of the Straits of Malacca and gradually developed it into a colony. Because of this colonial connection we find that India and Singapore have high has also partnered with India’s Larsen and Toubro for similar IT parks in other cities. Tourism has also emerged as a strong sector where the two countries have partnered with magnificent results.

As Indian companies see Singapore as a safe and reliable home, and a conducive and trusted springboard to start internationalizing their businesses, they prefer to open new verticals or expand the existing ones in Singapore. Their work ranges from IT services and education to logistics and manufacturing. As India is the fastest growing major economy in the world currently, and has been on a fast-growing spree for some time now, obviously needing to develop its infrastructure, Singapore companies’ work in India is mainly concerned with Urban Solutions, Power, Transport and Logistics to Food Processing and Education. As regional consumption is growing and infrastructure developments are taking place, both India and Singapore are in a good position to take advantage of each other’s economic fundamentals as well as the region’s growth opportunities.

Cultural Support

Furthering their ancient cultural linkages, India and Singapore have taken several initiatives towards greater people-to-people contact, expansion of tourism and mutual appreciation of each other’s cultures. Indian Presidents, including Dr A P J Abdul Kalam and K R Narayanan, had also played their parts in promoting scientific and cultural collaborations between both countries. During his visit to Singapore in 2005, Dr A P J Abdul Kalam proposed and facilitated collaborations between the Aeronautical Development Agency of Singapore and the Hindustan Aeronautics Limited of India for joint ventures in designing, developing, producing and marketing ASEAN Passenger Jets. Consequently, both countries have initiated engagements and joint programmes regarding aircraft maintenance, repair and overhaul in sync with the growing demands of international aviation industry. Next, both countries have joined hands for technological similarity of institutions and practices, both are quite conversant with the English language, and of course a large number of Indians are part of the Singaporean community.

The relationship has only improved with each passing year. India recognized Singapore as a new and independent country within 15 days of its independence in 1965. Growing on its economic reforms during 1990s and 2000s, India made Singapore one of its strategic partners and on the wings of its Look East Policy created a host of mutual opportunities.

Matching Economic needs

India and Singapore are natural partners in economic and trading activities as India has been making efforts to integrate its economy with the global economy, while Singapore has a small domestic market and it has been looking outward. India’s integration with global economy means more exports, liberal policies for businesses, and more foreign direct investment. As Singapore initially found it difficult to enter the developed market due to cut-throat competition, it found Indian policies and market quite friendly. Soon, the mutual ground of advancement turned into unlimited opportunities for private businesses of both the countries, which were duly supported by mutually beneficial economic and political policies by both governments.

The focus of Singapore’s investment strategy in India has been on promoting private investment from Singapore in India, asking countries like Japan to invest in India and exploring the possibilities of collaborative investment in third countries. It has also focused on infrastructure sector, and has been mainly involved in the development of ports and their upgradation, roads and constructions. The Port of Singapore Authority (PSA) together with the South India Cooperation (Agencies) Limited (SICAL) had upgraded the Tuticorin port in Tamil Nadu, and then the PSA together with the Government of Gujarat had develop a container terminal at the Pipavav port in Gujarat, which became India’s first private sector-run port. The Singapore-based consortium of International Seaports Private Ltd. (ISPL) had upgraded the Kakinada project in Andhra Pradesh.

Singapore’s another area of focus has been development of software technology parks in India, such as the Madras Corridor and International Tech Park Limited (ITPL) near Bangalore. Lee Kuan Yew had taken an active interest in the Madras Corridor project, while his successor, Goh Chok Tong, helped the Bangalore ITPL project become a success. A consortium of Singapore companies led by Ascendas International, the Tata Group and the Karnataka State Government with respective holdings of 40, 40 and 20 per cent, brought success to the project.

Singapore’s Ascendas International cooperation in the field of information and communication technology, biotechnology, biochemistry, pharmaceuticals, efficient use of energy resources and space research. They have also signed an MoU for setting up a Task Force in Information and Communications Technology and Services.

In addition, during his visit to Singapore in 2000, K R Narayanan facilitated Cooperation in the Arts, Heritage, Archives and the Library for two years through an Executive Programme. Both countries also signed an MoU on the loan of artifacts to the Asian Civilization Museum of Singapore during his visit, and on the basis of the presence of a large Indian diaspora in Singapore and India’s Buddhist tourist places, they have been trying to revive their centuries-old cultural linkages. Both countries have decided to jointly develop the Buddhist religious tourism circuit in India and revive a multidisciplinary university in Nalanda in Bihar, because of its importance as the first-ever university in the history of human civilization and one of the great centres of Buddhist learning in the ancient times.

Greater Significance

India and Singapore have helped each other strengthen their larger strategic relationship in the entire Indo-Pacific region. They have created opportunities for exchanges, visits, and exercises, and also for the Singapore military to train in India. Other countries within and without the region have also recognized their strategic and security cooperation in the larger context of Indo-Pacific region. All relevant countries watched closely when both countries held defence ministers’ dialogue in November 2018 and inked a new naval pact.

In 2018, Prime Minister Narendra Modi hosted all ten ASEAN member states in New Delhi for India’s Republic Day in favour of India’ Act East Policy. The usual annual, overall the 25th time, Singapore–India Maritime Bilateral Exercise (SIMBEX) also took place from November 10 to 21. They also held Exercise Agni Warrior, which is the bilateral artillery exercise of the Singapore Army and the Indian Army. This is expected to continue on in 2019.

Simultaneously endeavouring to deepen their economic ties, both countries have been paving a path of mutual peace and prosperity for each other. This included their steps towards equal access, as a right under international law, to the use of common spaces on the sea and in the air. These are significant steps which would mean in the short- and long-term freedom of navigation, unimpeded commerce and peaceful settlement of disputes in accordance with international law.

Using ASEAN as a powerful platform, India and Singapore have not only created strong bilateral relations with each other, but have also taken steps towards creating a powerful front of regional security and a rules based order for peaceful settlement of disputes.

A joint statement laid out a broad vision for the relationship’s development, spanning defence to cultural and people to people exchanges. It also reaffirmed a shared commitment to maritime security and freedom of navigation, as well as safety of sea lanes in accordance with international law, such as the UN Convention on the Law of the Sea.

The strategic partnership will see regular high-level meetings at the level of Defence Ministers, the continuation of joint military exercises across all three service arms and collaboration in defence technology and co-production of weapons.

With Mr Modi pushing infrastructure and smart cities as a key plank of his development strategy, urban solutions a key Singapore strength – has gained salience in the relationship. The two sides agreed to enhance cooperation in sustainable smart city development with Mr Modi urging Singapore to explore the possibility of developing urban centres under the Smart Cities Initiative.

Another agreement on civil aviation will open opportunities for collaboration in development of Indian airports. Singapore is India’s largest trading and investment partners in ASEAN. The increasingly close relations between India and Singapore in recent years have been underpinned by a dramatic growth in bilateral trade.